Payaza, a rising player in the African fintech space, said it has obtained approval for a ₦50 billion Commercial Paper issuance program from FMDQ (Financial Markets Dealers Quotation) Exchange. This move is part of the fintech startup’s commitment to revolutionising digital payments and financial solutions across the continent.

Payaza announced today in a statement reported by PUNCH that the funds would enhance its liquidity, enabling the company to scale operations, diversify its offerings, and solidify its market leadership in Africa. The company’s vision is to become the continent’s premier payment gateway, delivering secure and innovative solutions tailored to meet Africa’s unique financial needs.

The approval of this commercial paper program comes at a pivotal time for Payaza as it works to deepen its presence in underserved markets. The funding will empower the company to address critical service gaps and support small and medium-sized enterprises (SMEs) with accessible financial tools.

Seyi Ebenezer, CEO of Payaza, stated, “This milestone reflects the trust and confidence placed in our vision by financial stakeholders. It serves as a testament to our commitment to providing innovative and inclusive financial solutions that drive growth across the continent.”

Similarly, the company’s Chief Technology Officer, Philips Akinyele, noted, “Beyond financial gains, this approval represents a significant step in our journey to bridge the financial inclusion gap in Africa. We aim to continue creating robust solutions that empower businesses and individuals to thrive.”

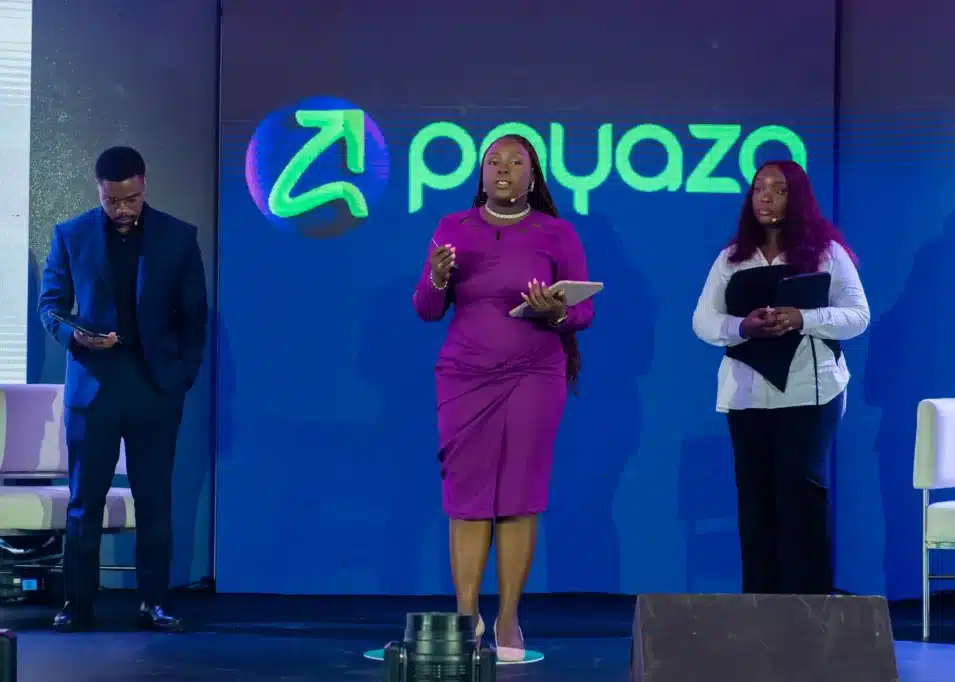

Earlier this year, Payaza rebranded with a new logo, a revamped website, and an updated application interface. This rebranding aimed to align with the company’s renewed vision for the future and included the launch of new products designed to connect African businesses with international markets.

The company also earned an investment-grade rating from Global Credit Rating (GCR), a subsidiary of Moody’s, which highlighted its sound financial structure and strong governance. These achievements have positioned Payaza as a reliable partner in Africa’s fintech ecosystem.

The Commercial Paper program’s approval is set to reinforce Payaza’s ability to lead in innovation. With these funds, the company plans to enhance its technological infrastructure, develop new products, and create employment opportunities.

By leveraging these resources, Payaza aims to make significant strides in driving financial inclusion and supporting economic growth. The company’s commitment to empowering SMEs and bridging financial service gaps positions it as a key player in shaping the future of Africa’s digital payment systems.

As Africa’s fintech industry continues to expand, Payaza’s ambition and strategic planning stand out. The ₦50 billion program is not just a financial milestone; it is a reflection of the company’s dedication to transforming lives and businesses through technology and innovation.