Cofounder vesting schedules are a foundational element in startups, ensuring fairness, stability, and alignment among team members. This guide, Understanding Cofounder will explore what vesting schedules are, how they function, and their significance in maintaining equity distribution in startups.

What is a Cofounder Vesting Schedule?

A vesting schedule determines how cofounders earn their ownership stakes over time. Instead of granting equity upfront, shares are earned incrementally, ensuring that cofounders remain committed to the business for a specified period. If a cofounder departs prematurely, they forfeit unvested shares, which can then be redistributed within the company or reserved for future use.

Vesting primarily serves two purposes:

- Encouraging commitment by tying equity to long-term involvement.

- Protecting the startup from losing substantial equity if a cofounder leaves early.

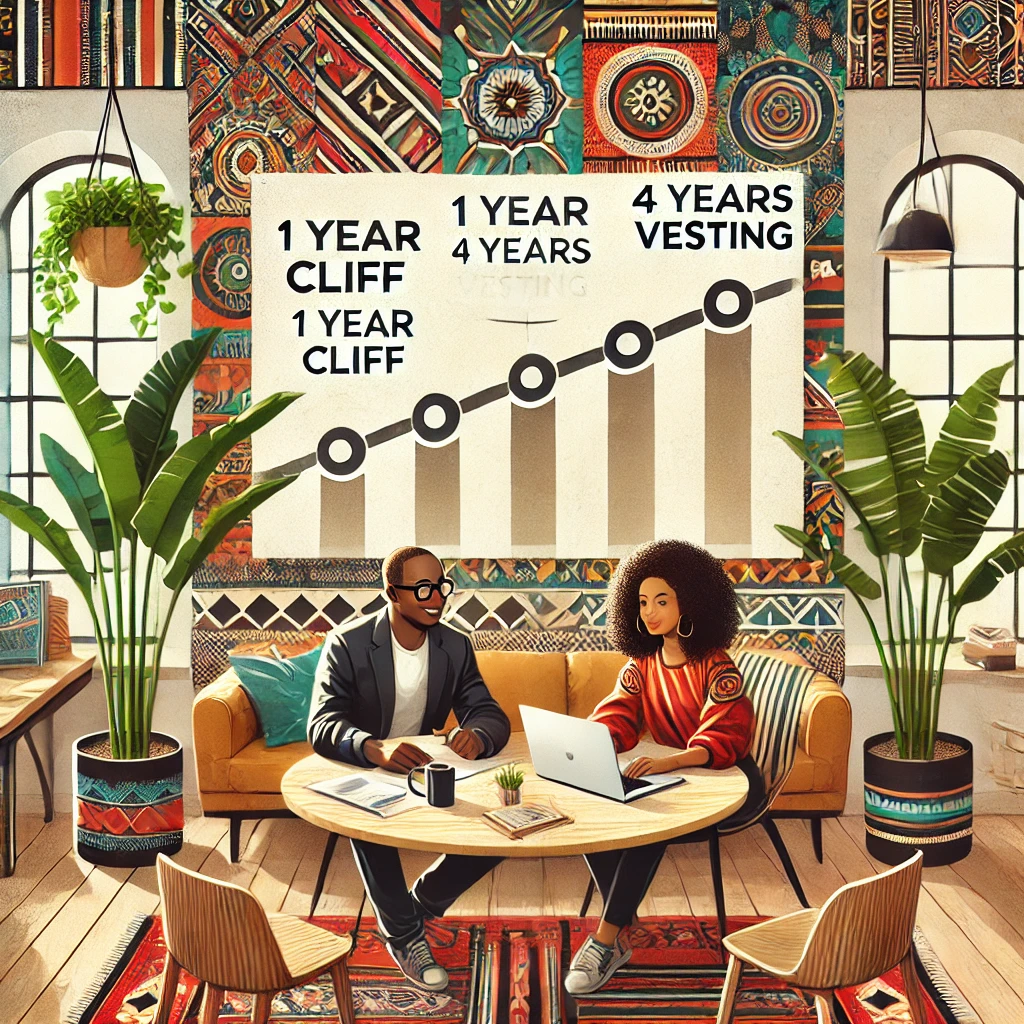

Key Components of Vesting Schedules

- Duration: Most startups adopt a four-year vesting schedule, commonly used by investors and founders alike.

- Cliff Period: This is a trial phase, usually lasting a year, during which no equity vests. At the end of the cliff, a lump sum (typically 25% of the total equity for a four-year schedule) vests. Afterward, shares vest incrementally, often monthly. Understanding Cofounder

- Unvested Shares: These are shares not yet earned by a cofounder and are forfeited if they leave the company early. This mechanism safeguards equity for active team members or future hires.

How Does a Vesting Schedule Work?

Example: A startup allocates 4,800 shares to each cofounder, spread over four years with a one-year cliff.

- Cliff Period: No shares vest in the first year. At the end of year one, 1,200 shares (25%) vest.

- Monthly Vesting: From month 13 onward, 100 shares vest each month until all shares are vested by the end of year four.

If a cofounder exits the startup after two years, they retain only vested shares—2,400 in this case—while the remaining 2,400 are forfeited.

Types of Vesting Schedules

- Time-Based Vesting:

- Linear Vesting: Shares vest evenly over a specified period (e.g., monthly or annually).

- Cliff Vesting: No shares vest until the cliff is reached, after which they begin vesting incrementally.

- Performance-Based Vesting:

- Shares vest when predefined milestones, such as revenue targets or product launches, are achieved. This aligns equity with measurable contributions.

- Hybrid Vesting:

- Combines time-based and performance-based criteria, requiring both tenure and achievements for shares to vest.

Why is a Vesting Schedule Important?

- Prevents Equity Dilution: Vesting ensures that only committed cofounders retain ownership, preserving equity for those driving the company’s growth.

- Investor Confidence: Investors view vesting as a safeguard, ensuring cofounders are incentivized to stay and contribute to the startup’s success.

- Resolves Disputes: By establishing clear rules upfront, vesting agreements help mitigate conflicts over equity if a cofounder departs.

Special Scenarios in Vesting

- Accelerated Vesting:

- In some cases, such as an acquisition, vesting may accelerate, allowing cofounders to earn all unvested shares immediately.

- Good Leaver vs. Bad Leaver Clauses:

- Good Leaver: Retains vested shares upon departure for reasons like illness or mutual agreement.

- Bad Leaver: Forfeits all shares (vested and unvested) for misconduct or breach of contract. Understanding Cofounder

Best Practices for Cofounder Vesting

- Start Early: Establish a vesting agreement as soon as the startup is formed to avoid misunderstandings.

- Customize Agreements: Tailor vesting terms to the needs of your business and cofounders.

- Consult Legal Experts: Ensure your vesting agreement complies with local laws and protects all parties involved.

Cofounder vesting schedules are an essential tool for startups to manage equity, foster trust, and promote long-term collaboration. By implementing a clear and fair vesting plan, startups can create a foundation for sustainable growth and innovation.

For more detailed insights, visit sources like Y Combinator and Startup Savant.