Nigerian fintech, Billboxx, offering invoicing and cash flow solutions for Small and Medium-sized Enterprises (SMEs), has raised $1.6 million in a pre-seed funding round. The company plans to channel the capital into scaling operations, expanding its team, and enhancing product features to better serve its clientele.

Investors and Funding Details

The $1.6 million funding, comprising a mix of debt and equity, was secured from prominent investors including Norrsken Accelerator, Kaleo Ventures, 54 Collective, P2Vest, and Afrinovation Ventures. This financial backing underscores the growing interest in innovative solutions addressing SME challenges in Africa.

Addressing SME Cash Flow Challenges

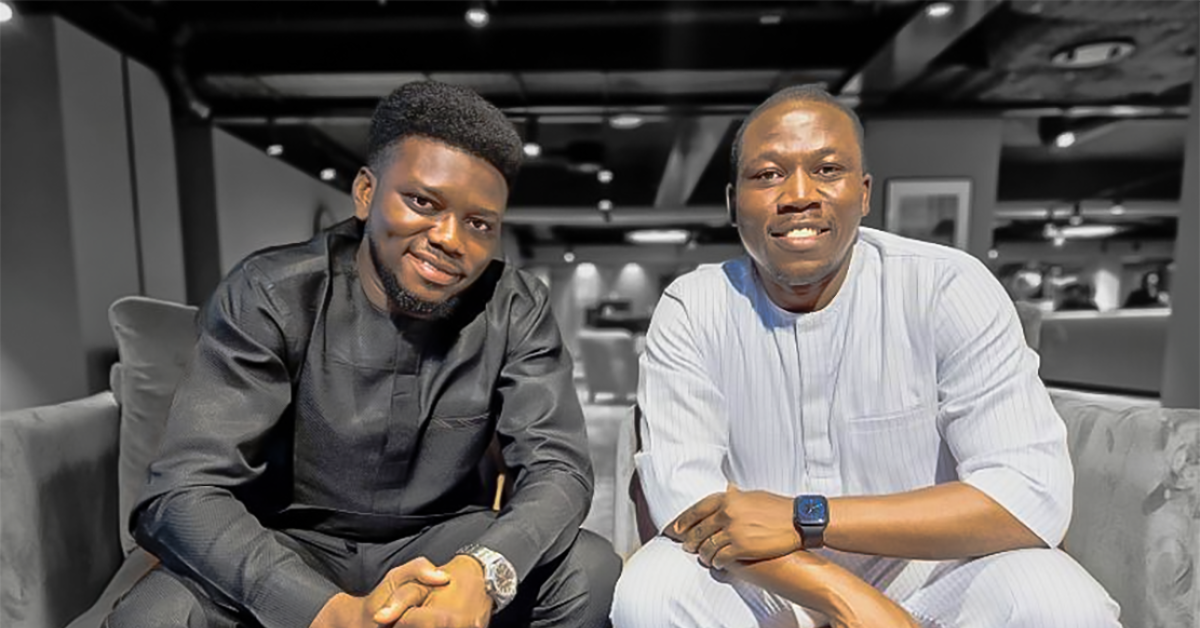

Founded in 2023 by Justus Obaoye and Abdulazeez Ogunjobi, Billboxx was established to tackle cash flow issues plaguing SMEs, which frequently experience long or delayed payment cycles from larger enterprise partners. The company’s invoice financing solution provides advance payments to SMEs ahead of client payments, ensuring steady cash flow crucial for business operations.

However, SMEs using Billboxx must first secure approval from their enterprise clients for payment authorization. The platform charges up to 5% for invoice financing and 1.5% in transaction fees for payments processed through its system.

Operational Milestones and Unique Model

Billboxx reports processing over ₦1 billion monthly without any defaults, a testament to the platform’s reliability. “We realised that every business we interacted with faced billing inefficiencies and cash flow problems. Many still rely on manual or Excel-based invoicing,” said co-founder Justus Obaoye.

The fintech serves SMEs primarily but also partners with larger enterprises to expand its reach. Current clients include Monument Distillers and the International Institute of Tropical Agriculture (IITA). By leveraging its unique distribution model, Billboxx acquires SMEs through its partnerships with these larger entities.

A Differentiated Approach

Unlike competitors focusing on mid-market and enterprise-level businesses, Billboxx prioritizes solutions tailored to SMEs. “We aim to become the financial operating system for SMEs in Africa,” Obaoye stated. This vision drives the company’s strategy and product development.

Future Plans and Expansion

Looking ahead, Billboxx plans to extend its footprint across Africa while introducing a new feature designed to help SMEs access market opportunities within corporate ecosystems. Though details of this feature remain undisclosed, it signals the company’s commitment to innovation and growth.

Conclusion

With its robust financial backing and a clear focus on addressing the unique challenges of SMEs, Billboxx is poised to redefine financial operations for small businesses across Africa. The company’s innovative solutions and ambitious goals make it a key player in Africa’s fintech landscape.